About Us

We’re a private lending company committed to providing fast, reliable capital for real estate investment projects—including fix & flips, new construction, and value-add rehabs. Our mission is to empower investors, developers, and operators with relationship-driven funding when traditional financing falls short.

Alpha Funding was founded on a simple principle: make private capital accessible to investors who need speed and flexibility. From our very first deal—a short-term loan for a fix & flip—we’ve grown into a trusted lending partner serving markets nationwide.

With a team experienced in real estate, lending, and capital markets, we understand the pace of this industry. That’s why we focus on quick closings, common-sense underwriting, and clear, responsive communication every step of the way.

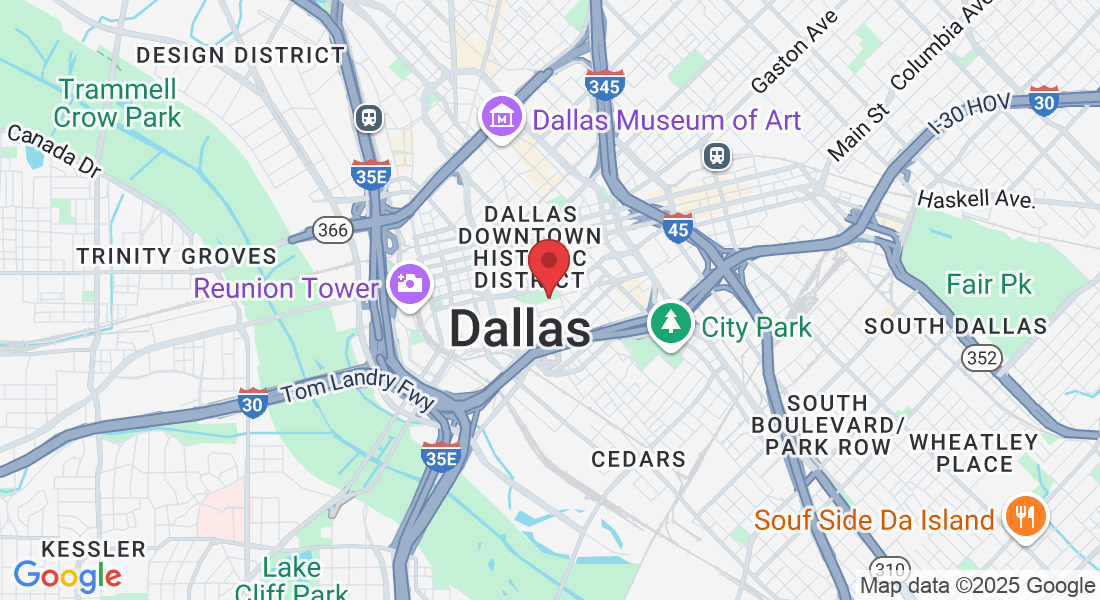

Today, our reach spans across the U.S., including key markets in New Jersey, New York, Pennsylvania, Florida, Texas, California, and Georgia.

Whether you’re just starting out or scaling up, our goal remains the same: help you close more deals with confidence—and capital you can count on.

Leadership Team

Chief Executive Officer (CEO) - Leads loan origination and capital partnerships. Acts as the company’s strategic problem solver, ensuring fast and flexible funding for borrowers.

Chief Revenue Officer (CRO) - Oversees growth, marketing, and client relationships. Focuses on innovation and staying ahead of trends in private lending.

Managing Partner – Investor Relations - Drives strategic relationships and borrower experience. Brings a strong background in real estate investing and private capital.

Managing Partner – Operations & Capital Markets - Leads backend operations, portfolio strategy, and capital deployment. Ensures a smooth lending process and scalable infrastructure.

We currently lend in:

New Jersey, New York, Pennsylvania, Florida, Texas, Georgia, California, and several other active investment markets.

Frequently Asked Questions

What types of loans do you offer, and how do I know which one is right for me?

We offer a wide variety of loan options, including personal, business, and emergency loans, each designed to meet different financial needs. Our team works closely with you to understand your situation, ensuring we recommend the most suitable loan type that fits your goals, whether it’s expanding your business, managing personal expenses, or dealing with an unexpected financial burden. We take a personalized approach to guide you toward the best option.

How quickly can I get approved for a loan, and what is the process like?

Our approval process is designed to be fast and efficient, typically taking only a few business days to process your application. After submitting your required documents, our team will assess your eligibility based on your financial history and lending needs. We ensure you are kept informed throughout the process, and once approved, you’ll receive the funds quickly so you can proceed with your plans without delay.

What are the eligibility criteria for obtaining a loan from your platform?

The eligibility criteria depend on the type of loan you're applying for. Generally, you must be a resident of the country we serve, have a steady income, and meet certain credit requirements. However, we also consider factors like your repayment capacity and the purpose of the loan, providing flexibility for individuals and businesses alike. We encourage you to contact our team if you have specific questions regarding your eligibility, and we'll be happy to assist you.

How do your interest rates compare to other lending institutions, and are they fixed or variable?

We pride ourselves on offering competitive interest rates that are often lower than those available from other lenders. Our rates are transparent, and whether fixed or variable, we make sure you fully understand the terms before proceeding. Fixed rates provide stability, ensuring your payments remain consistent throughout the term of the loan, while variable rates can offer flexibility, adjusting to market conditions as needed. Our team will help you determine which option suits your financial situation best.

Can I repay my loan early without facing penalties?

Yes, we believe in giving our clients the flexibility to pay off their loans early without any prepayment penalties. If your financial situation improves and you wish to pay off your loan sooner than scheduled, you can do so without incurring any extra charges. Early repayment can help reduce the amount of interest paid over the life of the loan, and we encourage it as a smart financial strategy.

What happens if I miss a payment, and what options do I have if I’m struggling to make payments?

We understand that financial difficulties can arise, and we want to work with you to find the best solution. If you miss a payment, it’s important to contact us immediately so we can discuss options, such as deferring the payment or restructuring your loan. We offer flexible repayment plans and support to help you get back on track. Our goal is to ensure you are not burdened with your loan, and we are committed to working with you through any challenges you may face.

How do I apply for a loan, and what documents do I need to provide?

Applying for a loan with us is simple and straightforward. You can apply online through our website or by contacting our team directly. To complete your application, you’ll need to provide basic information, such as proof of identity, income details, and any relevant financial documents. Our team will guide you through the process, making sure all necessary paperwork is submitted correctly and efficiently to ensure a smooth approval process.

Call 2089701925

Email: